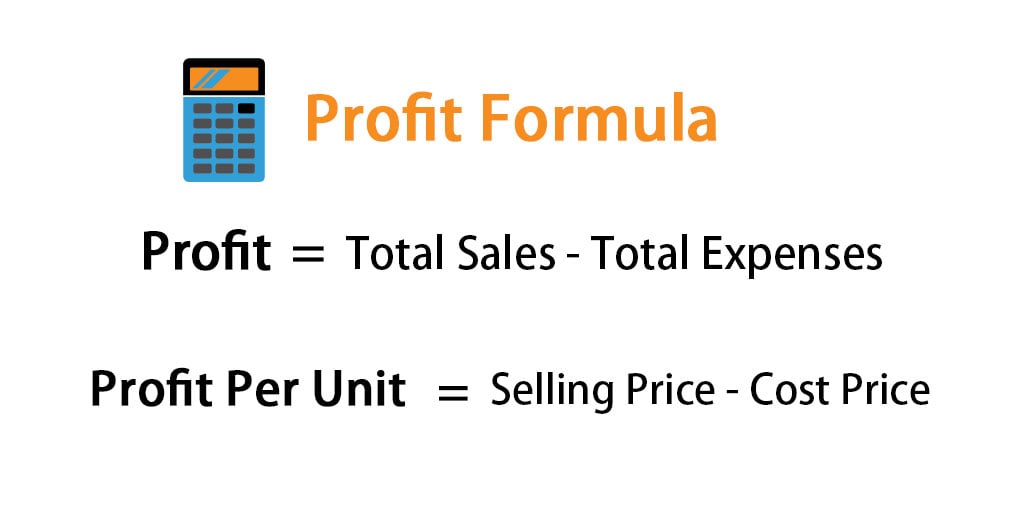

Profit amount formula

Profitability can be shown by calculating the gross profit using the gross profit formula. The target profit formula is a calculation used by businesses to estimate how much revenue the company should produce over a set period of time.

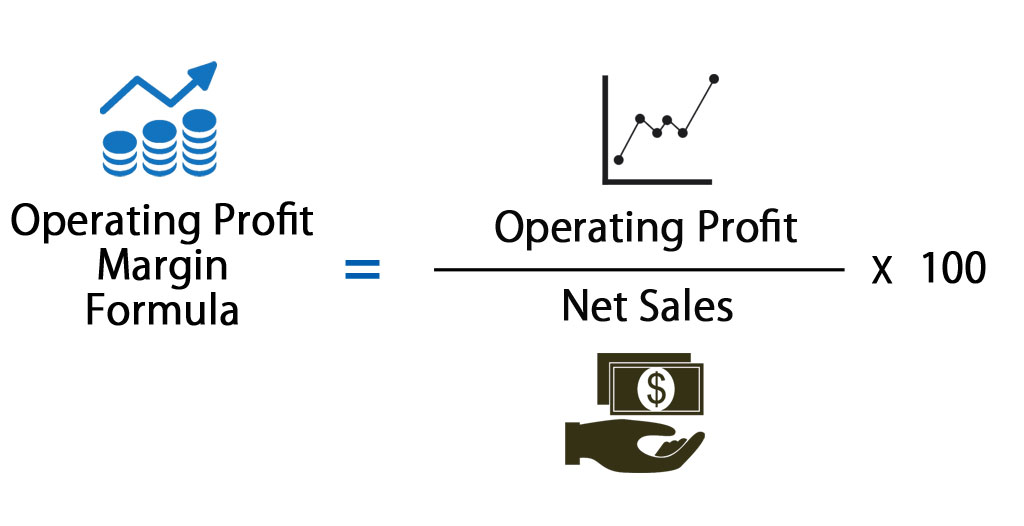

Gross Profit Margin Formula Meaning Example And Interpretation

Total Revenue - Total Expenses Profit.

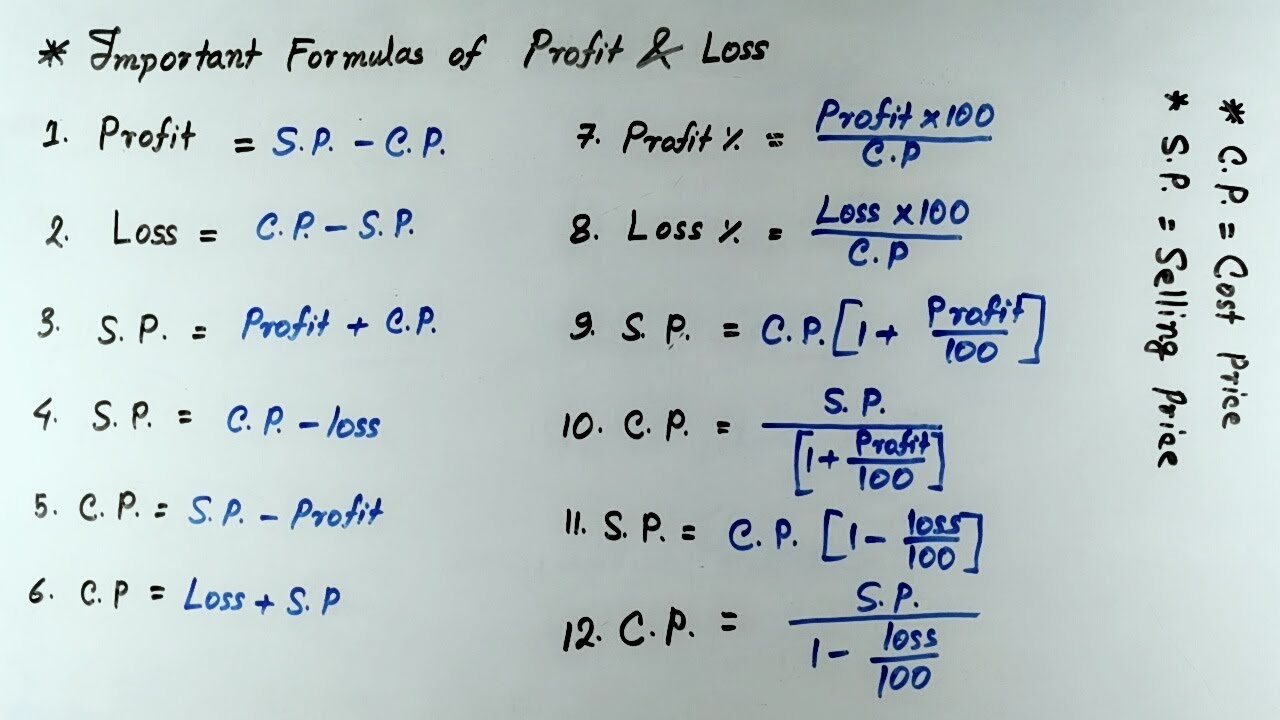

. Given Cost Price Rs150-And Selling Price. The formulas that are used to calculate the profit and loss percentage are given below. Using the above formula Company XYZs net profit margin would be 30000 100000 30.

Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Usually companies use this metric to help establish budgets forecast development potential and optimize investments. Gross profit indicates how much revenue a company has after deducting the costs of production.

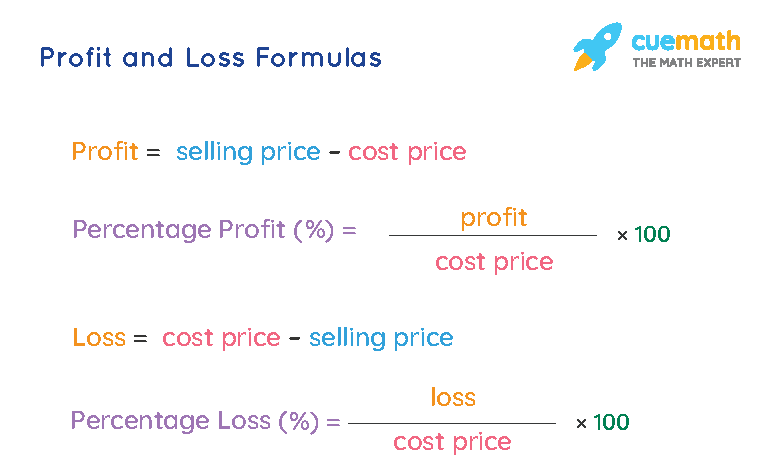

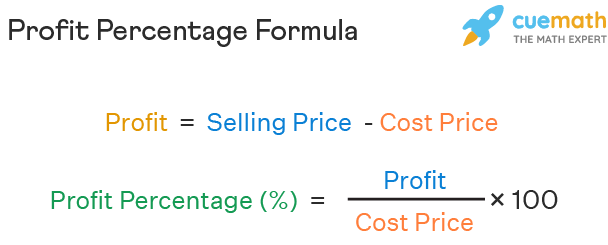

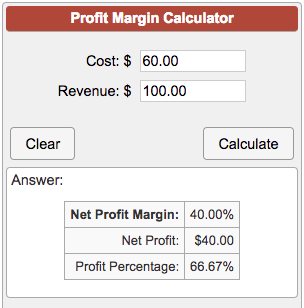

To calculate the profit margin of a business most organizations use the following formula. Then find the profit gained by the shopkeeper. Profit percentage P Profit Cost Price 100.

Shows Growth Trends. The optimal percentage for gross profit is 30 or higher. It should be remembered that the amount of profit or loss incurred is based on the Cost price.

Why Net Profit Margin Is Important. This formula is derived by evaluating the companys situation to achieve the break-even point Break-even Point In accounting the break even point is the point or activity level at which the volume of sales or revenue exactly equals total expenses. This standard percentage is sufficient to cover most business taxes.

Many organizations use these two terms interchangeably to describe the amount. What is the Formula for Profit. Using the formula above we can determine that.

Meaning of Gross Profit Formula. There are two main reasons why net profit margin is useful. The formula to calculate profit is.

It is the amount of profit before all interest and tax payments. It excludes the direct income and the expenses. Profit Margin Formula.

Multiply the profit margin with 100 to get in percentage. In other words it is a point at which neither a profit nor a loss is made and the total cost and total revenue of the. Net profit margin is the ratio of net profits to revenues for a company or business segment.

The profit percentage is always calculated on the cost price. Businesses use this amount as an indicator of their profit before expenses. Net Profit Margin Formula.

The main difference is that gross profit is a value whereas gross profit margin is a percentage. You can calculate economic profit as long as you know the total amount of revenue earned and the total cost involved using the following formula. Gross margin is a percentage of a businesss revenue while gross profit is the amount you get after you subtract the cost of goods sold COGS from revenue.

To calculate the profit margin divide the profit amount with cost price. The income statement formula consists of the three different formulas in which the first formula states that the gross profit of the company is derived by subtracting the Cost of Goods Sold from the total Revenues and the second formula states that the Operating Income of the company is derived by subtracting the Operating Expenses from the total gross profit arrived. If a shopkeeper sells Apple at Rs200 per kg whose cost price is Rs150- per kg.

Gross profit is the money or profit that a company makes after the selling cost and receiving cost is deducted. Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period. Gross margins must remain high to afford operating expenses.

The profit margin formula is net income divided by net sales. The gross profit formula subtracts the cost of goods sold from revenue which shows the amount that can finance indirect expenses and investments.

Gross Profit Percentage Formula Calculate Gross Profit Percentage

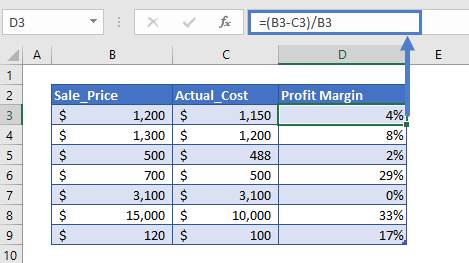

Profit Margin Calculator In Excel Google Sheets Automate Excel

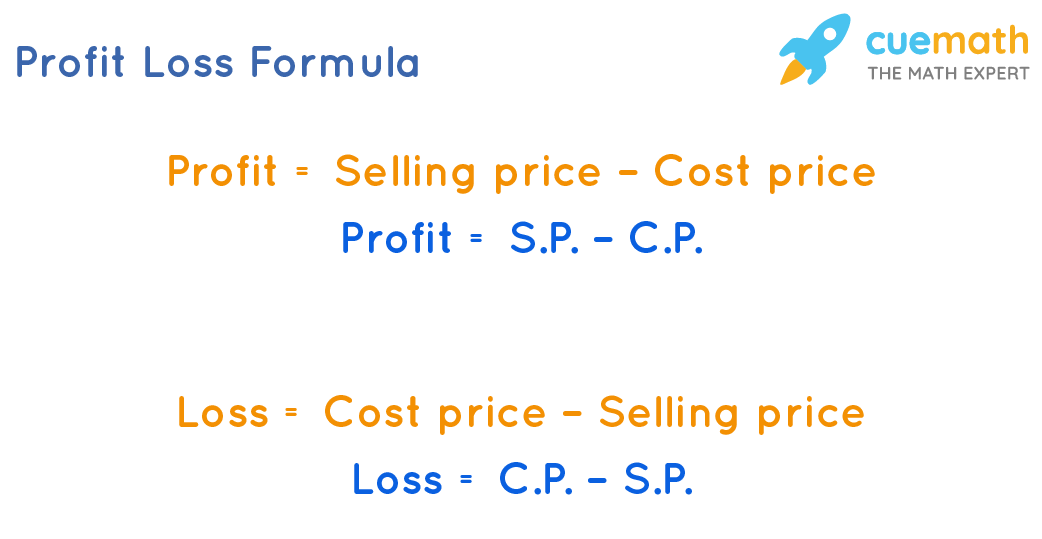

Profit And Loss Formula Examples Derivation Faqs

Profit And Loss Formula Definition Calculation Examples

Profit Formula What Is Profit Formula Examples Method

Profit Formula Calculator Examples With Excel Template

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

Operating Profit Margin Formula Calculator Excel Template

Profit Margin Calculator

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Formula Profit Percentage Formula And Gross Profit Formula

Profit Margin Formula And Ratio Calculator Excel Template

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Percentage Formula Examples With Excel Template

Profit Loss Profit And Loss Important Formulas Youtube

Gross Profit Percentage Double Entry Bookkeeping

Find Sale Price When Profit Percentage And Cost Price Is Given Youtube